Bahigo Casino Erfahrungsbericht

Schweizer, aufgepasst! Vom Unternehmen Bahigo sollten Sie schon einmal gehört haben. Haben Sie nicht? Deshalb stellen wir hier Bahigo kurz vor und erklären, warum dieser exzellente Allrounder-Anbieter unserer Meinung nach Beachtung verdient hat.

Was ist Bahigo?

Bahigo Casino ist eine Plattform für Online Sportwetten und Casino Spiele, die früher unter dem Namen Rivalo bekannt war. An Rivalo war per se nichts falsch, aber dennoch gab es vor wenigen Jahren ein Rebranding und das Ergebnis war die Plattform Bahigo, wie wir sie heute kennen. Und man muss schon sagen: Das Rebranding ist gelungen! Bahigo präsentiert sich souverän und mit vielen Vorteilen, durch welche der Anbieter ganz schön konkurrenzfähig geworden ist. Die Sportwetten Fans und Spieler haben das auch gemerkt und mittlerweile ist Bahigo doch sehr beliebt geworden und hat sich eine stabile Fanbasis aufgebaut. Ein solch guter Ruf kommt nicht von ungefähr, und wenn Sie jetzt neugierig geworden sind, dann lesen Sie weiter, denn wir werden auf die wichtigsten Merkmale eingehen, die Bahigo zu einer solch guten Adresse machen.

Spielspaß im Bahigo Casino

Bahigo hat einen riesigen Vorteil, den wir gleich vorweg als Erstes nennen wollen: es ist eine Plattform für alles, was bedeutet, dass man hier sowohl Sportwetten als auch Online Casino Spiele zur Verfügung gestellt bekommt. Damit ist Bahigo einer jener Anbieter, bei denen man an einer Adresse so ziemlich alles finden kann, was es in der Welt des Online Glückspiels an Unterhaltungsmöglichkeiten gibt. Sowohl die Bereiche der Sportwetten als auch die Bereiche der Casino-Spiele sind auf ein und derselben Plattform integriert, sodass Kunden sich nur einmal anmelden müssen und dann mit diesem einen Konto Zugriff auf das gesamte Angebot haben. Bei Problemen gibt es den gleichen Kundensupport, es sind sozusagen immer alle Schäfchen unter einem Dach.

Selbstverständlich ist auch die Qualität des Unterhaltungsangebots selbst sehr wichtig, weshalb wir auf die verschiedenen Bereiche jetzt noch näher eingehen.

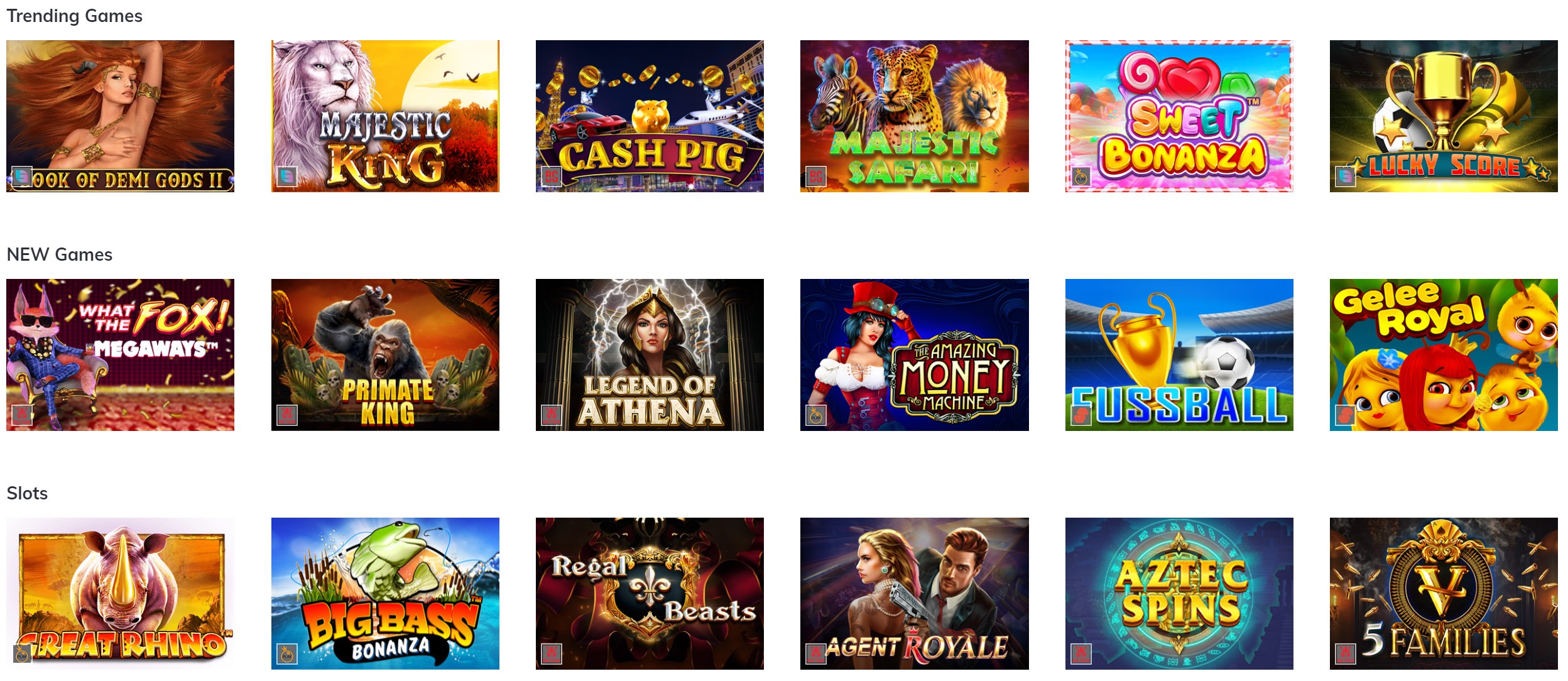

Spielautomaten und mehr

Spieler in Online Casinos haben es meistens sehr auf die Spielautomaten abgesehen. In der Welt der modernen Online Slots gibt es unglaubliche Auswahl, was an sich gut ist, aber mit der großen Auswahl kommt eben auch ein sehr breites Spektrum der Qualität, der Gewinnchancen und des Spaßfaktors. Natürlich gibt es einige berühmte Top Slots, deren Namen für ein exzellentes Spielerlebnis bekannt sind, wie zum Beispiel Aztec Bonanza, Book of Tombs und Legend of Cleopatra. Als Kunde ist man immer gut beraten, sich jedoch eher die Auswahl der Spielehersteller anzuschauen. Denn diese Hersteller der Slots bürgen mit ihrem guten Namen für die Qualität der Games. Bei Bahigo gibt es unter anderem Spielautomaten von:

- Betsoft

- Wazdan

- Pragmatic Play

- Relax Gaming

- Playson

- Booming Games

- Evolution Gaming

- Habanero

- Aspect Games

Live Casino

Im Live Casino Bereich von Bahigo können sich Kunden mit den qualifizierten und netten Live Dealern aus den Studios von Evolution Gaming vergnügen. Es gibt eine große Auswahl an Spieltischen, an denen man verschiedene Varianten von Poker, Roulette, Blackjack, Baccarat und mehr spielen kann. Das alles wird per Live Stream direkt auf die Bildschirme der Spiele übertragen, und man kann sich denken, dass die Leute das mögen, denn es kommt eine nette gesellschaftliche Atmosphäre auf – fast wie in der terrestrischen Spielothek eben.

Spannende Bahigo Sportwetten

Insgesamt kann man bei Bahigo auf Spiele von mehr als 20 verschiedenen Sportarten wetten. Diese Auswahl sorgt für Abwechslung, aber auch auf die Quoten kommt es natürlich an, und auch die verschiedenen Wettarten geben den Wettfans vielfältige Möglichkeiten, um ihr Fachwissen mithilfe eines Tippscheins in ein bisschen Taschengeld zu verwandeln.

Die populären Sportarten

Wer Wetten möchte, der hat in den meisten Fällen eine, zwei oder drei Sportarten, mit denen er sich gut auskennt und bei denen er dann regelmäßig Tipps abgibt. Das ist jedoch nicht immer so – viele Sportwetten Fans versuchen ihr Glück auch mal gerne an neuen Sportarten, und nicht selten kommt es vor, dass man sich erst wegen der Sportwetten in eine bis dahin unbekannte Sportart vertieft und die kennen und lieben lernt. Somit ist Auswahl der große Punkt, bei dem Wettanbieter wie Bahigo ihre Qualität demonstrieren. Folgende Sportarten werden unter anderem bei Bahigo für Sportwetten angeboten:

- Fußball

- Dota 2

- Tennis

- Snooker

- Basketball

- Beachvolleyball

Live Wetten

Auch Live Wetten bietet Bahigo an – das bedeutet, dass man auch dann noch Tipps abgeben kann, wenn das Spiel bereits begonnen hat. Es erklärt sich von selbst, dass dies nochmal eine extra Schicht von Spannung mit in die Sache bringt, denn es werden gleichzeitig die Gewinnchancen und auch die Herausforderung an die Wettenden erhöht. Wer eine gute Beobachtungsgabe hat und schnell Entscheidungen treffen kann, der kann bei den Bahigo Live Wetten von seinem klugen und kühlen Köpfchen profitieren.

Bahigo Willkommensbonus

Für beide Bahigo Hauptbereiche – Sportwetten und Casino – gibt es jeweils einen Willkommensbonus, den sich neue Kunden definitiv nicht entgehen lassen sollten. Leider kann man aber nicht beide Boni haben, sondern muss sich für einen entscheiden. Der Casino Bonus beinhaltet 100%-igen Einzahlungsbonus bis zu 750 Euro, den man sich durch eine erste Einzahlung von mindestens 20 Euro sichern kann. Dieser Bonus muss dann 40 Mal durchgespielt werden, um die Bonusbedingungen zu erfüllen. Außerdem gibt es noch 50 Freispiele beim beliebten Pragmatic Play Slot Mustang Gold.

Der Sportwetten Willkommensbonus begrüßt die Wettfreunde bei Bahigo mit einem 100% Einzahlungsbonus bis zu maximal 150 Euro – oder 200 CHF, wenn man in Schweizer Franken einzahlt. Auch hier gibt es Umsatzbedingungen und Bonusbedingungen, die man sich vor Inanspruchnahme eines Bonus auf jeden Fall durchlesen sollte.

Geldangelegenheiten bei Bahigo

Um es den Spielern und Sportwetten Freunden so einfach wie möglich zu machen, sollte ein guter Anbieter eine ordentliche Auswahl von Zahlungsmöglichkeiten akzeptieren, sodass jeder Kunde sich diejenige aussuchen kann, die er ganz persönlich präferiert. Bei Bahigo sind dies die üblichen und sehr sicher geltenden Transaktionsmittel, aber auch Einzahlungen und Auszahlungen mit verschiedenen Kryptowährungen werden akzeptiert.

- Ethereum

- Bitcoin

- Litecoin

- Ripple

- Neteller

- Skrill

- Paysafecard

- Kreditkarte

- MuchBetter

Sicherheit und Seriosität

Bahigo ist eine Marke des Unternehmens Blue Petter B.V., welches seinen Sitz auf Curacao hat. Von der Glücksspielbehörde in Curacao hat Bahigo auch seine Lizenz bekommen. Diese Behörde ist eine der ältesten ihrer Art auf der Welt und genießt einen sehr guten Ruf, auch wenn es nicht als die strengste Behörde gilt. Da Curacao zu Holland gehört, unterliegt alles niederländischem Gesetz. Selbstverständlich kann man sich daher auf höchste Standards in Sachen Verschlüsselung, Datenschutz, Spielerschutz und allgemeiner Fairness verlassen. Auch die vielen positiven Erfahrungsberichte, die man im Internet von anderen Bahigo Kunden liest, sprechen für sich.